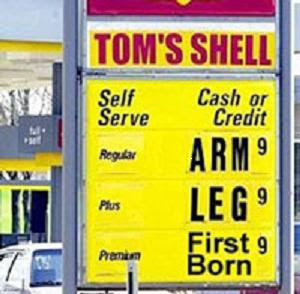

The price of oil is swinging violently and trending ever upwards. The NYT is at a loss to explain it:

The extreme volatility that has gripped oil markets for the last 18 months has shown no signs of slowing down, with oil prices more than doubling since the beginning of the year despite an exceptionally weak economy.

The instability of oil and gas prices is puzzling government officials and policy analysts, who fear it could jeopardize a global recovery. . . .

A wild run on the oil markets has occurred in the last 12 months. Last summer, prices surged to a record high above $145 a barrel, driving up gasoline prices to well over $4 a gallon. As the global economy faltered, oil tumbled to $33 a barrel in December. But oil has risen 55 percent since the beginning of the year, to $70 a barrel . . .

Read the entire article. The NYT goes on to quote speculation that the instability in Nigeria and Iran are playing a significant role in the rise in oil prices, but both of those are of recent vintage and do not account for the steady upward rise in oil prices since the beginning of the year.

Anyone who couldn't see this coming is not paying attention. I wrote a month ago, in the post "The Looming Crisis In Energy Costs," that we would soon face another energy crisis. None of the causes in demand that gave rise to $145 a barrel oil have disappeared permanently. Obama has refused to live up to his promise to allow expanded exploitation and exploration of our domestic oil resources - perhaps the only thing in the near and mid-term that could actually stabilize world oil prices. And on top of that, he has, with the cap and trade bill, declared war on our energy industry, particularly on coal which provides almost 50% of our energy. This is bound to increase demand for oil. Lastly, oil is priced in dollars. A weak dollar causes higher prices for oil - and Obama is in the process of destroying the value of the dollar.

As I wrote in the above referenced post, all of these factors are clear indicators that we can expect a real crisis in oil costs. There is no reason for the NYT to be mystified by the rise in prices over the past six months. Cause and effect are clear. The NYT just needs to start some honest reporting.

3 comments:

.

.

.

You may find MoM's take on this of interest

.

Quick money speculators drove the last one http://www.scribd.com/doc/16752803/The-Great-American-Bubble-Machine

Are they doing it again?

> Quick money speculators drove the last one

No they didn't, that was a hoary lie created by incompetents and spread by anti-capitalist idiots.

The steadily rising world economy combined with the rapidly increasing demand from both China and India, representing more than 2 billion people (i.e., about 1/3rd of the world's total population) drove the prices up.

The timing of the rapid drop in prices in coordination with the collapse of the bubble was hardly sheer coincidence.

Post a Comment